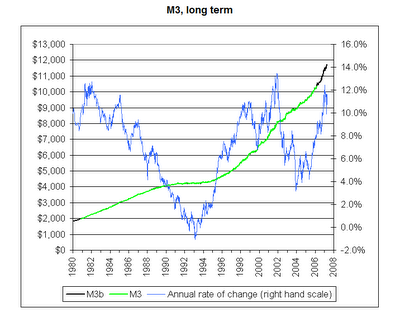

Money Supply is Soaring ... Right? posted - Wednesday, May 09, 2007 by Mike Shedlock / Mish  The above chart shows that money

supply as measured by M3 is soaring. I

suppose one could nitpick about the latest drop from +12% annual rate

of growth to +10% annual rate of growth but seriously that would be

just nitpicking.

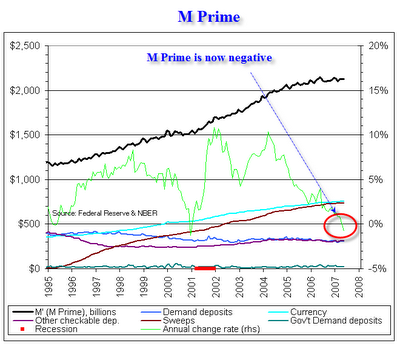

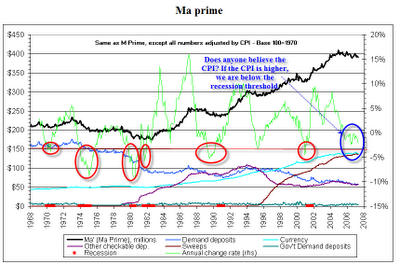

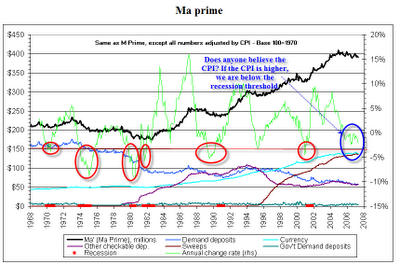

So money supply is soaring ... Right? Not so fast. Let's take a look at M Prime. I first talked about M Prime in Money Supply and Recessions. M Prime is based on Austrian economic theory that distinguishes money from credit. Those interested in the details can click on the previous link, but essentially M Prime approximates M1 with sweeps added back in. Sweeps are automated processes whereby banks clear (sweep) excess funds from checking account nightly into other accounts so that it can be lent out. Sweeps originated in 1994 and with sweeps the last semblance of any sort of reserves went right out the window. With the minor exception of things like travelers checks accounting, M Prime is pretty much a reconstitution of what M1 looked like prior to 1994. Here are a few charts.  Long Term M Prime

Note: The latest sweeps data we

have is from

March. That data was extrapolated forward through the first week in

May. A quick look at the above charts will show this is likely to be a

minor consequence. Thanks to economist Frank Shostak for the idea

behind M Prime. Thanks to Bart at NowAndFutures

for reconstructing M3 and for the charts in this post.

Hmmm. M3 is soaring while M Prime is contracting... So what's it all mean? What does it mean?

This post originally appeared in Minyanville. Jeffrey Cooper on Minyanville is writing about Hoofy in La La Land. You may wish to check it out. Mike Shedlock / Mish http://globaleconomicanalysis.blogspot.com/ The content on this site is provided as general information only and should not be taken as investment advice. All site content, including advertisements, shall not be construed as a recommendation to buy or sell any security or financial instrument, or to participate in any particular trading or investment strategy. The ideas expressed on this site are solely the opinions of the author(s) who may or may not have a position in any company or advertiser referenced above. Any action that you take as a result of information, analysis, or advertisement on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions. Cached/copied - 08-09-07 - mpg See also an analysis of this article by Gary North - Monetary Statistics |